arizona charitable tax credits 2020

Adult Behavioral Health Therapeutic Home. The maximum allowable credit for contributions to public schools is 400 for married filing jointly filers or 200 for single married filing.

Charitable Tax Deductions By State Tax Foundation

10 rows Arizona Small Business Income Tax Highlights.

. The platform offers complete donation management tracking and integration. We are a qualified charitable organization for this credit. Name of Organization Address Phone QCO Code Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20841 Arizona Assistance in.

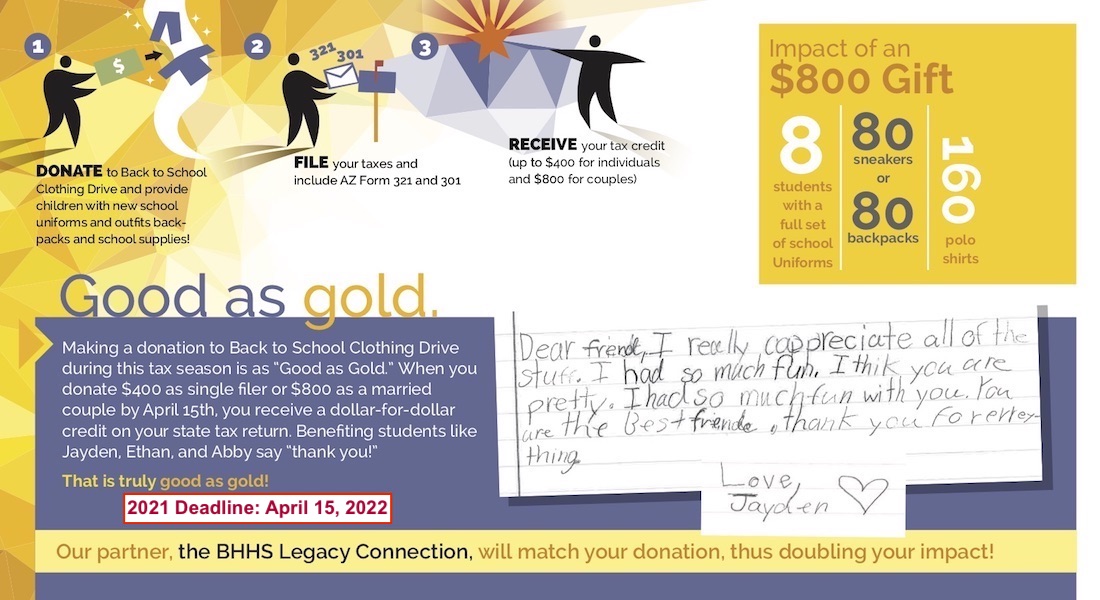

This credit is limited to the amount of tax calculated on your Arizona return. This change is in effect until June 30 2022. Consider the example of a single taxpayer who makes a 400 donation to an eligible.

Individuals may give up to 400 couples can. For the Arizona Credit for Contributions to Charitable Organizations Form 321 only Cash. For all of them you.

The Arizona Charitable Tax Credit gives taxpayers more choice in how their tax dollars are allocated. February 5 2020 311 PM. Due to the COVID-19 outbreak the deadline for filing and paying State and Federal income tax has been extended from April 15th 2020 until July 15th 2020.

The platform offers complete donation management tracking and integration. Just make sure to your contribution to RMHCCNAZ up until. A taxpayer can only claim a tax credit for donations made to certified charities.

Browse Our Collection and Pick the Best Offers. Ad Register and Edit Fill Sign Now your AZ DoR Form 301 more fillable forms. Rules for Claiming Arizona Tax Credits for Donations.

Check Out the Latest Info. There are four major tax credits that you can use to offset certain charitable donations in Arizona. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity.

Name of Organization Address QCO Code Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20493 Benevilla 16752 N Greasewood St. The lists of the certified charities on azdorgov displays the certified charities for that year. The maximum contribution allowed is 800 for married filing joint filers and 400 for single heads of household.

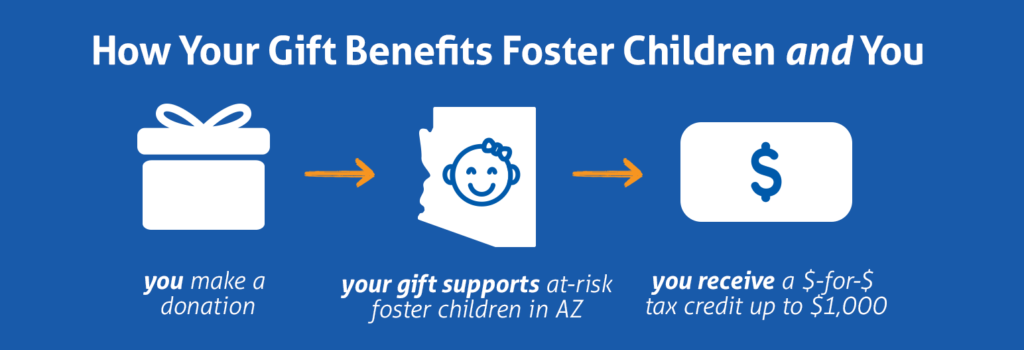

You may receive a dollar-for-dollar tax credit for contributions to the following types of charitable organizations. For voluntary contributions made to a qualifying foster care charitable organization QFCO see credit. Create Legally Binding Electronic Signatures on Any Device.

Learn how to maximize your impact with a Schwab Charitable donor-advised fund. Ad Givelify is the most widely-used charitable donation platform for nonprofits. Ad Arizona tax charity credits.

Make a donation to the National Kidney Foundation of Arizona by April 15th 2021. Arizona Tax Charity Credits. Start the Process - AZ Tax Credit Funds.

1 Best answer. Ad Givelify is the most widely-used charitable donation platform for nonprofits.

Score A 2020 Arizona Tax Credit Henry Horne

Donate Your Arizona Charitable Tax Credit Habitat Central Az

Az Tax Credit Information Emerge

Arizona State Tax Credit Esperanca

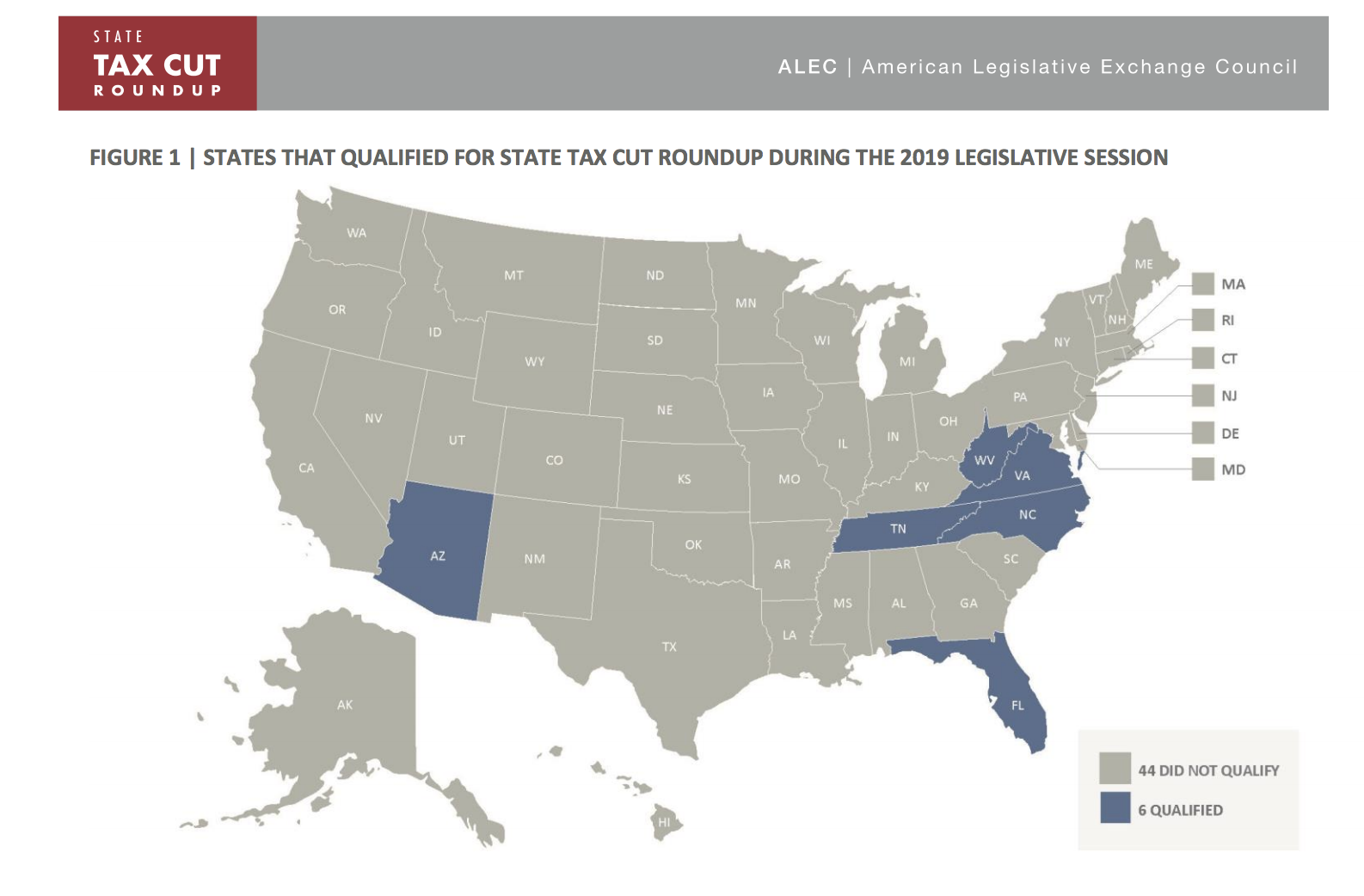

Report Arizona Leads In Tax Relief Office Of The Arizona Governor

Know Your Arizona Tax Credits For Charitable Contributions Thompson Wealth Management

Arizona Charitable Tax Credit Back To School Clothing Drive

Home Prescott Area Tax Credit Coalition

Give Hope With Your Tax Credit The Catholic Sun

Charitable Tax Credit Jewish Free Loan

Calculating Your State Tax Liability 2020 Fsl Org

List Of 6 Arizona Tax Credits Christian Family Care

Yavapai Casa For Kids Foundation Your Donation Can Earn You Tax Credits Signals Az

List Of 6 Arizona Tax Credits Christian Family Care

Az Tax Credit Donations Opportunities In Phoenix Az Ryan House

Qualified Charitable Organizations Az Tax Credit Funds